I found Delish Finance on April 18, five days after its initial Whitelist presale, and figured it would serve as an excellent case study for a token bound to lose about half its value; I figured about a week. Not to be misunderstood, I actually think their premise is really innovative if not perhaps lofty. Inevitably setting up a blockchain to tokenize restaurants as NFTs is going to be a challenge, but sounds like a great way to decentralize financing in a tight profit margin industry, and that’s Delish’s idea in a nutshell. I liked the team too: fully doxxed, Black male leadership – possibly three brothers – and a mostly Black team. This is exactly the kind of project I would want to toss some money at, but they suffered from a glaringly critical issue: their token distribution was going to sink the coin.

Token distribution among wallets is mostly overlooked as an important tokenomics evaluator: it’s usually not shared in the typical crypto marketing channels as clearly as it perhaps is on a token’s website, which retail investors may never bother to check out. Sometimes you’ll have to read the token’s whitepaper to actually understand a coin’s supply allocation, and some won’t even have it there. After deployment you can find a token’s distribution using the blockchain, but reading wallet allocations and tracking transactions isn’t exactly in the average retail investor’s repertoire. But a token’s distribution reveals critical information to the discerning.

Fundraising For Liquidity

Let’s use Delish Finance’s setup to demonstrate how a token’s distribution is similar to a company’s balance sheet particularly for quantifying leverage and identifying value at risk in a meaningful way. On April 13th Delish conducted a pre-launch “Whitelisting” sale, a pre-purchase of tokens typically at a cheaper price than will be initially offered to the general public on a DEX. Delish sold almost 25% of its pre-mainnet supply (remember Delish wants to start its own blockchain), or almost 110M Delish in this Whitelisting event. The amount of money raised here is important for two reasons.

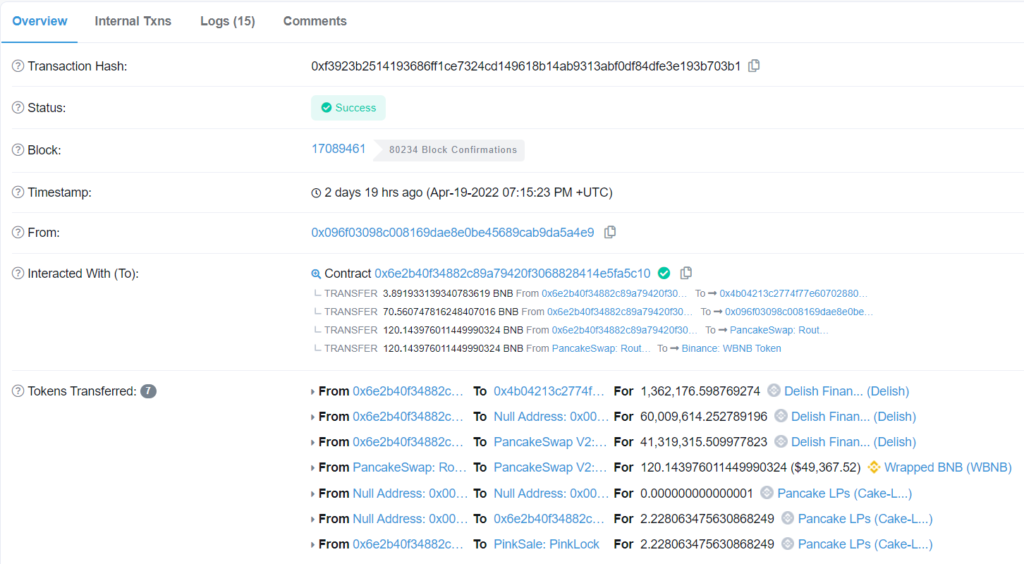

First, the money raised during Whitelisting and other pre-launch sales typically funds the liquidity pool for the token’s DEX launch. Although the presale for Delish had a hardcap of 300 BNB (over $126,000 based on BNB’s price at launch) the team only put up a fraction more than 120 BNB for the initial liquidity pool, just short of $51,000. That $51k was paired with 41,319,316 Delish to form the initial LP.

This illuminates the second reason: the prelaunch token valuation is connected to the launch value entirely by seigniorage. Mechanically you’re printing paper for sale to Paul to collateralize other paper you’ve printed to exchange with Peter, Paul, and their friends. Based on normal DEX token valuation and assuming the entire initial liquidity pool accounts for all the funds raised in Whitelisting Delish Finance sold each token at about $0.000465 during the Whitelisting versus a DEX launch value of $0.00122847. It’s possible all 300 BNB was raised and that more than half never made it to the liquidity pool (overhead costs are real things), meaning the Whitelist sale had a price closer to $0.0012.

Either way we run into a concept common on company balance sheets: leverage. The tokens sold in the Whitelist sale were unvested and made up almost 25% of the pre-mainnet token supply. The liquidity pool, presumably funded by the Whitelist, accounted for less than 10% of tokens. This naturally leads to leverage: some of the tokens unlocked in circulation aren’t backed by liquidity. In Delish’s case 2.5 times as many tokens were distributed than allocated to fund the liquidity pool.

Hopefully the financier in everyone right now is asking “what happens if those Whitelist buyers sell?” And why wouldn’t they with arbitrage built into the market (the ratio of tokens whitelisted versus sent to the liquidity pool is slightly different from the ratio of funds raised versus added to the liquidity pool, ensuring a higher launch price)?

Leverage is typical for a lot of newly launched tokens, including highly successful ones. It isn’t inherently bad, but it requires healthy standards.

Presales vs. Liquidity Pools: The Magic Ratio

What makes leverage healthy in this space? Vesting is priority: vested tokens are equivalent to long term debt on a balance sheet. It’s a concern, just not right now. Delish Finance had about 47.5% of its circulating supply locked up in vesting.

The 25% of tokens that made up the Whitelist sale though were unlocked and available for holders to sell after the DEX launch. I would argue that the ratio between the sum of tokens like these held in wallets and the liquidity pool is akin to the quick ratio often calculated by fundamental stock market investors. Because nearly every newly launched cryptocurrency is going to use some level of leverage on fundraising you can’t think of this ratio the same way – the question isn’t if but how much bigger the unlocked presold token count is compared to the liquidity-matched tokens.

For Delish the liquidity pool had 30% of the number of tokens held in open wallets by either Whitelisted presale buyers or marketing contractors. The magnitude of the difference likely matters due to the probability distribution around how many tokens presalers will sell early in the launch (time matters because ultimately this is a marathon between buyers and sellers to add or subtract from the liquidity pool).

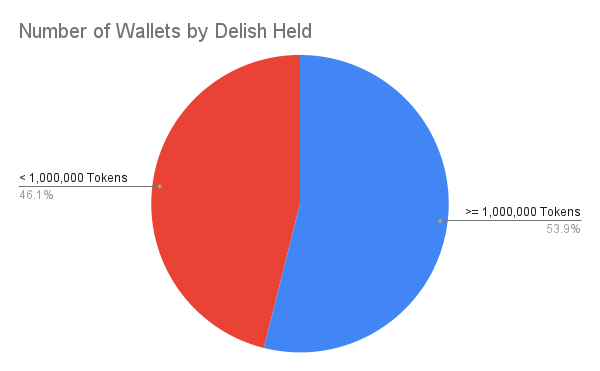

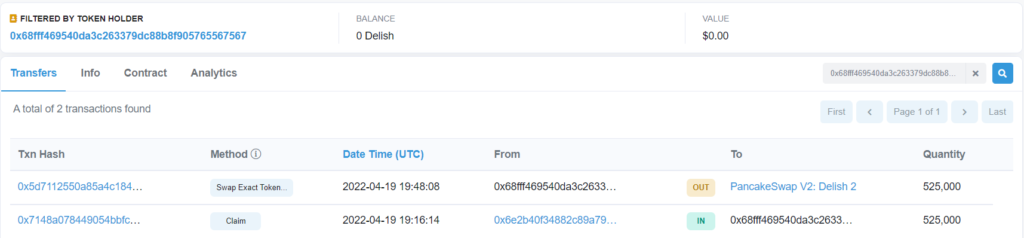

That leads to the other measure of leverage healthfulness: the distribution of presale tokens and the risk tolerance of holders. In Delish Finance’s case of the 128 presale wallets airdropped tokens 69 or almost 54% received one million or more tokens each. Compare that distribution to one like MOVEY’s with an even presale distribution, balancing out the probability that a risk averse holder will wind up with a larger than average wallet. An inequitable distribution like Delish’s increases the probability that the risk averse disproportionately receive large airdrops.

When Whitelist Whales Meet Fractional Liquidity

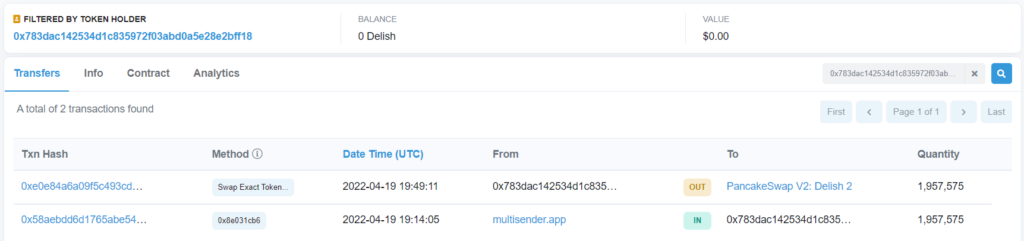

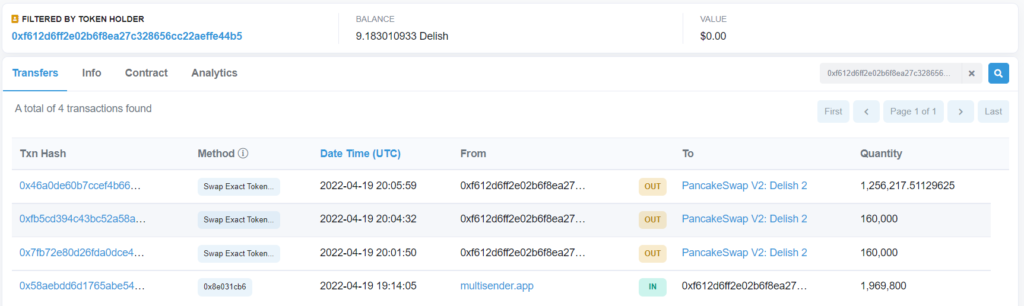

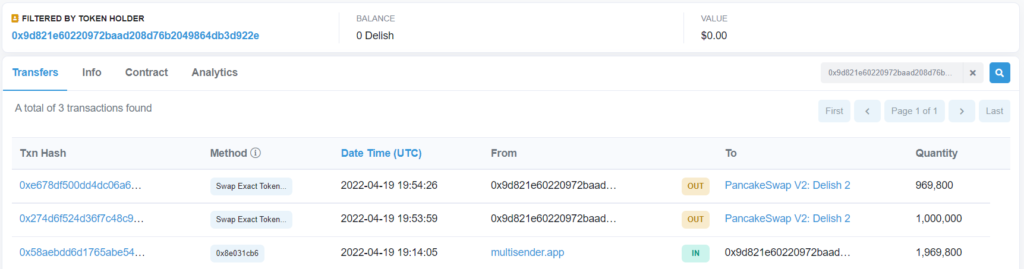

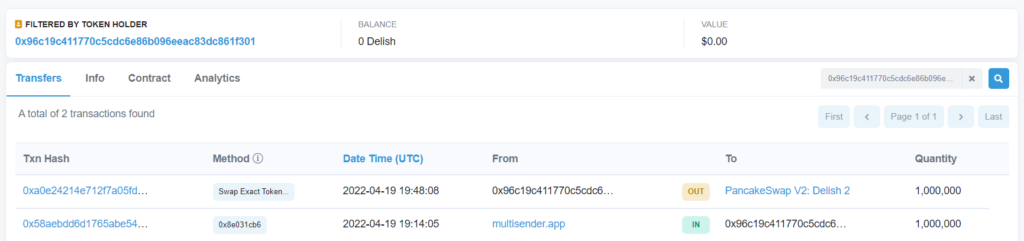

And perhaps they were. The first human sale back to Delish’s liquidity pool came from one of the Whitelisted wallets less than a minute after launch: 60,000 Delish for a little less than $75, or about $0.00125 per token. Actually I would bet that the majority of sales in the first half hour of trading were either bots who bought splits of a second before their sale or Whitelist wallets seeking exit liquidity.

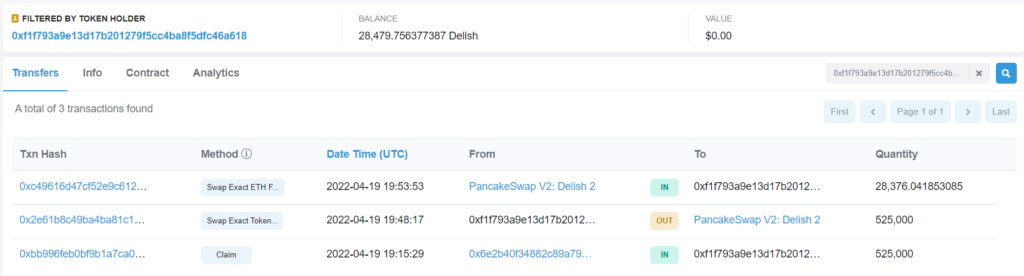

Buy pressure was winning out for the first thirty minutes despite receding bot volume before the first major turnaround was triggered by the first of the 69 Whitelisted buyers holding more than one million tokens dumping their entire bag on everyone who just bought Delish and refilling it with more than $2,200 or over 4% of the initial liquidity pool at $0.002217 per token. By the end of the furious selloff that followed for forty-five minutes the price had more than halved from its all time high and the coin was down almost 30% from its starting market cap.

The token would have had a chance if one wallet wasn’t able to snatch away five percent of the original liquidity pool without an offsetting buy event, a problem made worse as any necessary complementing event becomes more expensive for potential buyers watching the token price climb. These are good problems to have in the absence of wallets holding up to 2% of the unlocked token supply. Then it just becomes a leveraged liability.

You’ll need some serious diamondhanded sentiments to overcome an early wallet sale of that magnitude in a market full of sensitive chart readers and technical analysts. I’ll admit that holder sentiment matters for risk aversion – presales to true believers are always preferred to those to speculators – and therefore makes a difference in how easily an irrecoverable selloff happens. But there’s also the influence of wallet distribution design, which arguably might be all that matters for the first few hours after a token launch.

Delish Finance designed a token distribution bound to trigger a 10% drop in price for every 2M tokens sold by Whitelisted whales. Three wallets alone had 2M tokens each. Thirty-nine wallets had over 1.5M tokens. This quickly becomes a dangerous gamble.

Critically analyzing Delish Finance’s token distribution led to a sober, swift assessment of how much and how unhealthfully the team was leveraging its presale financing. Relatively severe leverage paired with a statistically abnormal distribution of token holders was the recipe for Delish Finance’s, and many other tokens’ selloffs. As of this writing Delish Finance’s market cap is still more than 50% down from its opening. If I saw it coming this time, you can next time.