Who understands the science of what they’re doing and who’s grifting and full of waste becomes apparent when a market’s pool of capital dries up. It’s easy to seem brilliant and right when money is amply flowing and all the lines are going up. It’s when turmoil occurs, when smart money becomes discerning and dumb money keeps walking into traps that you start to see who’s really in regal garb and who’s actually naked and should be afraid. Celsius is the latest victim of the lines not going up, but others don’t have to fall prey to the same fate.

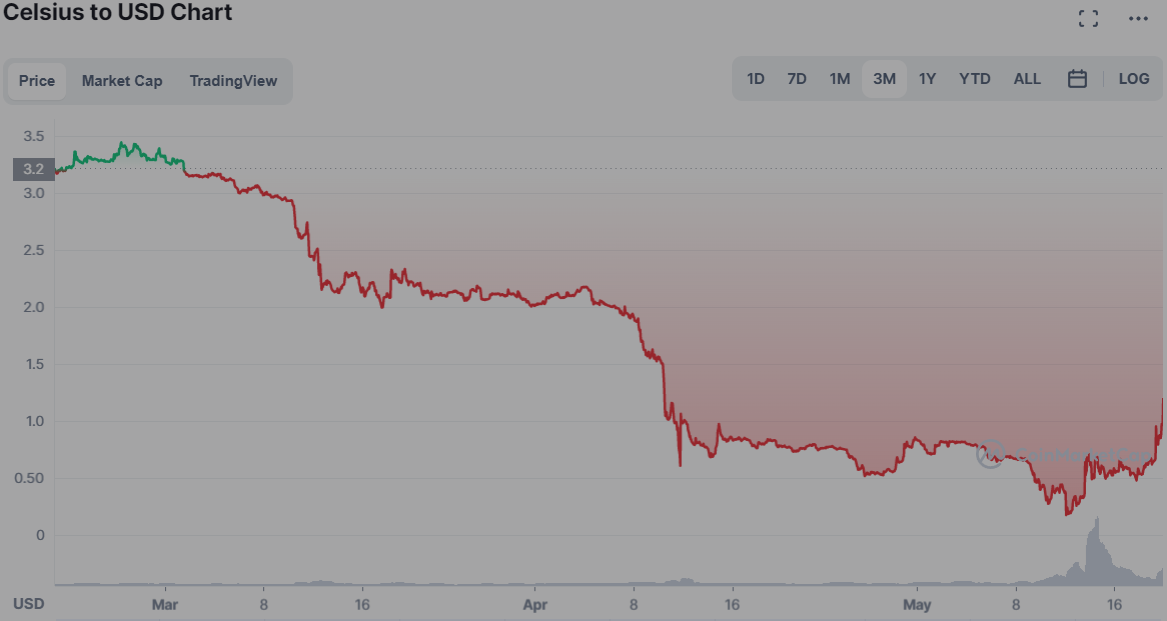

Based on the last few months it seems to be that season again for the crypto markets. Capital flowed out of the alt-coin market in March, in no small part due to Russia’s violent escalation of conflict in one of the most crypto-popular regions on Earth, and didn’t see itself resurrected in the mainstream markets as we all hoped the fighting and displacement would translate into crypto remittances. Meanwhile pie-in-the-sky experiments started to tumble. The most absurd To-Earn concepts got wrecked right as people genuinely experimented with rewarding sleep and sexual activity.

Many thought the stablecoins were going to function like inflation protected bonds, and they were so wrong. Studying bank runs and contagions can go a long way to preparing you for crypto market movements, and certainly this was proven with the classic bank runs that occurred on Terra and other algorithmic stablecoins, and is occurring on Tether. Celsius may seem like it’s falling to the same issue but there’s more at play. Somewhat unique but rather classic financial mechanics are at play, and this life-shattering disaster for some may have been avoided with the vigilance of a competent financial scientist, like an economist.

Nothing About Celsius’ Business Model Works In Stormy Markets

Imagine a platform where you could take out loans using your house as collateral, and short the homes others have used as collateral too. The example isn’t perfect because homes aren’t currency, but what’s at stake is similar after you consider that users of Celsius’ Wallet were putting in their life savings as uninsured deposits. And this was effectively the backbone of Celsius’ model, according to its Whitepaper. So I hope the example weighs on your mind: this platform was facilitating borrowing against your uninsured life savings – denominated in volatile currencies with positive correlations to the rest of the crypto and financial markets – while placing bets that other people’s life savings would lose value in the short to medium term. How was everyone not bound to lose?

It all works while the lines go up, short bets are discerning and infrequent, people take out loans only to find that their collateral has appreciated faster than their debt. It’s the kind of thing that grifters have wet dreams about, because the fundamental flaws in their analysis, logic, or operations go unchallenged. In bull markets you can be oh so wrong and still be oh so rich. And despite the moderately complicated but equally ill-informed financial engineering behind the platform, it was easy to discount gimmicky critiques of commercial banking and absurd interest rate promises… as long as the lines went up. If the line goes up, no one needs to explain the mechanisms behind any of their magic money printers.

When the line stops doing that though the entire house collapses. Suddenly it doesn’t seem bright to have users shorting the assets they’re using to collateralize their loans. Securitizing yield farming becomes a major risk when impropriety happens, market-wide transaction volumes plummet, and stablecoins and pegged currencies get tested by liquidity runs. The bridge between Celsius’ finances and sanity was made of thin ice and we’re entering a sweltering summer for crypto if you haven’t noticed.

This house-of-cards cycle is inefficient and unnecessary, but inevitable as long as crypto remains an industry for people with psuedo-intellectual thoughts to run off with capital. Grifters make attractive promises and deliver fluff and deferrals rather than solutions. Their tactics for delaying detection get applied to their business strategies, leading to platforms built to sustain their deception as opposed to being sustainably built. All of this is transparent, but mostly to the rational and financially literate. It’s more than apparent now that Celsius had more unsavory and inexperienced managers than actual financial professionals or scientists, but that was true all along if you were paying attention. Analog-era financial exploitation of consumers can be addressed, but the solutions are far more likely to come from creative, liberation-minded economists than psuedo-intellectuals, peacocking-grifters and white-collar thieves.