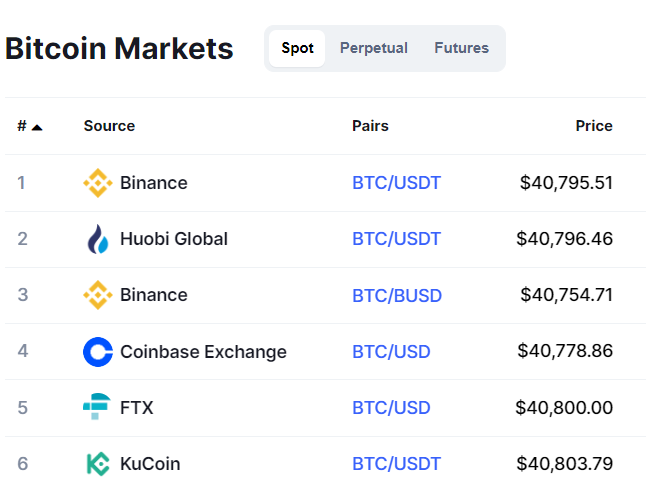

I’ve seen price determination for cryptocurrencies very often described as a “blackbox” of demand, supply, spice, everything nice, and an accidentally toppled bottle of Chemical X. And such is frankly the case most often with major tokens on multiple CEX markets that have varying levels of liquidity. Bitcoin has hundreds of markets listed on CoinMarketCap; they’re each going to have their own price and estimates might as well be expressed as ranges. But for the majority of tokens launched everyday particularly on DEX markets: a basic understanding of tokenomics reveals the major determinants of price in such a way that enables really precise modeling of isolated buy and sell effects.

Market Capitalization and Liquidity Pools

First, the common denominator for valuing tokens across DEXs tends to be their market capitalization. It means little for a token to be worth $1 if only $10 worth of market cap exists. Sensibly then we need to establish what variables determine market cap if we want to model pricing. Since market cap is the value of all tokens in circulation it’s determinants are best expressed as MC = Price of a token * Number of circulating tokens. If the price of a token is unknown then the question is: are there any variables that help us understand the number of circulating tokens, or the market cap, while illuminating what the price may be?

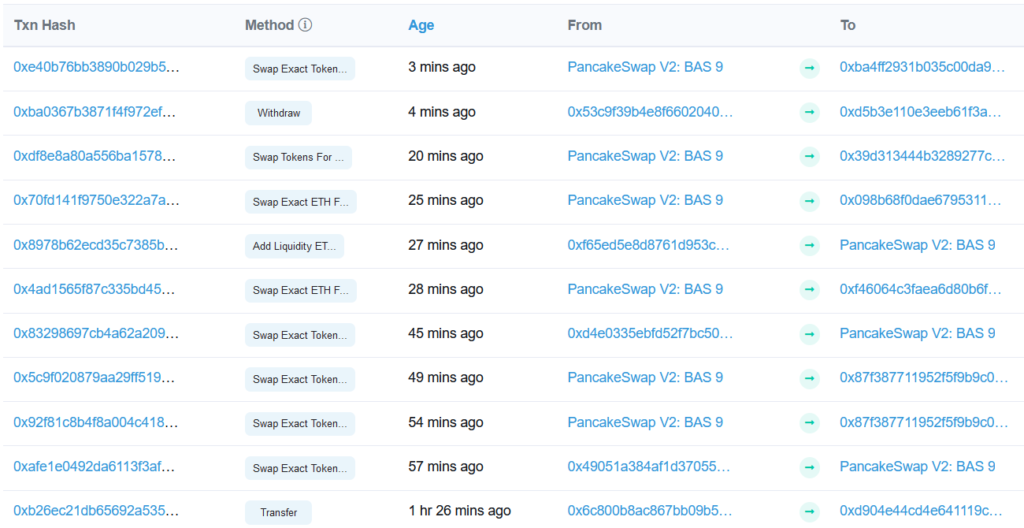

Liquidity is a relevant variable in determining price in most markets; the absence of liquidity naturally pushes prices up for currencies and vice-versa. The number of tokens held in liquidity is also a known variable on most DEXs like Pancakeswap. For example, using a sniper bot designed by the BSC SAFE Sniper Team I can identify how much of a paired token, like BNB, is in the liquidity pool for another token, like Block Ape Scissors (BAS), and therefore the value of the liquidity pool.

Here’s the math to get there: if 3308.56 BNB is paired in liquidity pools with 4% of BAS’ circulating supply of tokens, and BNB at this point is valued at $425.88 per BNB then by implication 4% of the circulating supply of BAS is backed by (3308.56 * $425.88 =) $1,409,049.53 worth of BNB.

This is illustrated in sample SAFE Sniper output below.

The “Trader Of Last Resort”: The Token Contract

Knowing that 4% (roughly, it’s 4,220,516.32 BAS tokens actually representing 4.2205% of circulating supply if you check BSC Scan) is important because the liquidity pool or “contract” acts effectively as the trader-of-last-resort on DEXs. Rarely do traders on Pancakeswap actually buy and sell all of their tokens to an explicit matching trader in the market. If you don’t believe me just read the blockchain of virtually every BSC traded token: 99% of the interactions are between the liquidity pool, usually Pancakeswap, and a private wallet. Most of the time everyone is buying from and selling to the liquidity pool – in the process taking out and adding liquidity – causing a change in the number of paired BNB to BAS, and therefore a change in the “price” of the next token bought or sold by the liquidity pool.

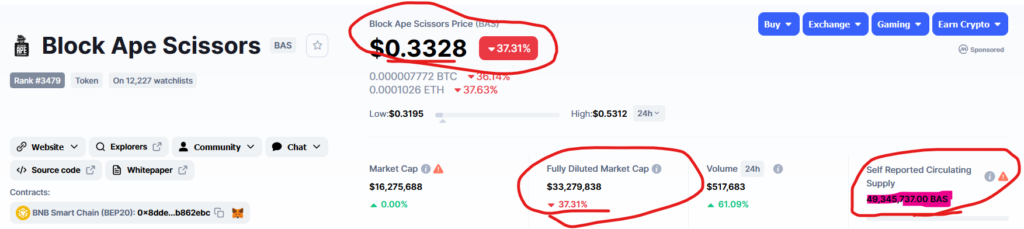

Don’t believe me? Let the math continue: if that 4% is valued at $1.4M of BNB, then the entire circulation (100%) is worth ($1,409,049.53/4% =) $35,226,238.32. That’s really close to the market cap reported by our SAFE Sniper output. If I use the precise 4.2205% denominator I get to within three hundred thousand of the actual market cap, $33,385,843.69.

The Tokenomics of DEX Market Pricing

At this point I have both sides of my equation to determine price. Information about liquidity easily attainable from BSC Scan gives me both the market cap and the number of tokens in circulation (4,220,516.32/4.2205% = 100,000,386.68) which we can confirm at 100,000,000. Even if I only had these imprecise data points, I can get to the price point almost precisely. Price = Market Cap / # of Circulating Tokens, or Price = $33,385,843.69/100,000,386.68 = $0.3338. If I use the actual variable values then Price = $33,278,838/100,000,000 = $0.3328. And what does CMC have the price of one Block Ape Scissors token listed as?

Was it magic that led us to the answer? The dark arts? No. It was a fundamental understanding of tokenomic mechanisms applied to an equation. It’s the type of equation building I did nearly daily modeling personal income tax revenues at the New York City Mayor’s office. I rest assured that if you tried this on most other DEX traded tokens, you would arrive at similarly proximate values.

This is also different from price prediction. This model doesn’t predict whether a buy or sale will happen. But I can take this model to reasonably predict what the price of BAS would be from this starting point if, say, someone sold 200,000 BAS tokens to the “contract” AKA the liquidity pool. That would add 200,000 BAS to the LP and extract $66,550, not accounting for “slippage” as each coin sold is worth less than the one prior, from the LP. The new liquidity would be roughly $1,342,489.53 backing 4,420,500 BAS for a likely new price point of $0.3036. That might be useful for modeling value at risk for your token launches.

Cryptocurrency is a fairly new space, with a lot of people taking cover behind “blackbox” explanations for gaps in their practical knowledge, especially regarding token economics or “tokenomics.” So if someone tells you all of pricing in crypto is just unpredictable or impossible to model, maybe you should reach out to me.